property

& request an Applicant Screening Package

& authorizes

will be notified automatically

property

will be notified automatically

taking into account all of the above!* * Included with entire package

Quick ProcessAll you need is your prospects full name and email address to get started. Reports are generated within minutes of prospect authorization. |

Eliminate Guess WorkReceive the help of our “Applicant Screening Assistant” to guide your decision making process. |

||

Easy to useGenerate and send acceptance, decline and adverse action letters automatically. |

It’s FreeThere is no cost to landlords and property managers, as the prospect pays the application fee. Of course, should the landlord or the property manager decide to pay the settings can be changed to do so! |

||

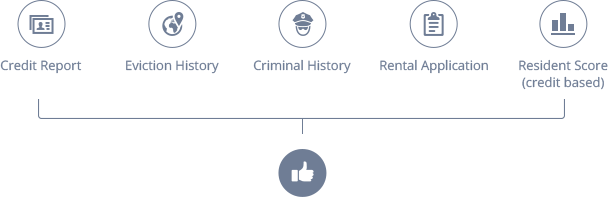

Get The Whole storyDon’t rely just on credit checks, as it doesn’t give you enough information. We review the tenant's credit history, just like a credit score. But with the help of TransUnion we run the credit history through a different formula to compile a Resident Score. Based the preset parameters and rental information you enter our Applicant Screening Assistant will flag items marked for detailed further review. |

Decide With ConfidenceReports are powered by TransUnion, a trusted source of consumer data. |

- Our “Applicant Screening Packages” are all inclusive. They include rent application, credit report, criminal history, eviction history, credit based resident score and the help of our Applicant Screening Assistant.

- Tenant credit report will show payment history of your applicant.

- Criminal history report will search and shows results from millions of national and statewide criminal records, including public registries such as Most Wanted Databases and the National Sex Offender Public Registry.

- Eviction history report will search and show results of over 24 million records from all 50 states and Washington, DC.

- Credit based resident scores give you a prompt snapshot of your rental applicants’ financial status; specifically, the reliability and level of risk they may bring. Your applicants will be awarded a score from 0 – 999, with 999 being the best score possible. This score is designed to interpret a credit report for you, and takes that data into account when determining whether or not that applicant will be a good fit for your rental property.

- Our Applicant Screening Assistant will flag criteria for further detailed review based on landlord’s preset rental parameters and prospect’s background reports, resident score and their ability to pay.

- Mitigate Fair Housing risk by screening tenants in a manner to reduce the occurrence of fair housing complaints.

- Customizable rental parameters based on weighted risk.

- Compliant with FCRA imposed reporting limitations.

- Screening prospects has no impact on applicant’s credit score.

- Personal information is kept private and all forms are completed securely online.